Bringing Low-Carbon Cement To Market

This article kicks off a three-part series exploring low-carbon cement’s potential to decarbonize a critical building material — and the challenges of bringing it to market.

Cement is quite literally the glue that holds much of the modern world together. It is the most widely used industrial commodity today, and the world consumes about half a ton of cement per person per year.

But despite the crucial role it plays in society, cement also puts a major strain on the environment. Cement production currently accounts for 3 percent of the world’s energy consumption and emits roughly 4.5 percent of global greenhouse gas emissions (GHGs). And its contribution to climate change is only rising as demand for cement keeps growing.

Finding ways to reduce emissions from the cement sector is critical for the world to meet its goal of limiting global warming to 1.5℃ to avoid the worst effects of climate change, but the sector has proven stubbornly difficult to decarbonize. Between one-half and two-thirds of the overall emissions from cement manufacturing today arise from a critical chemical process called calcination. These emissions are hard to avoid.

This challenge is prompting a major drive to develop and deploy technologies and solutions that can address these process emissions, including a significant uptick in startup activity and VC interest in low-carbon cement.

In part one of this three-part series, we offer a primer on cement and its growing emissions problem, and how low-carbon cement can solve these emissions challenges.

Cement’s Growing Emissions Problem

Cement is the backbone of the construction industry. It is a binding agent that is combined with sand, gravel, or crushed stone and water to create essential building materials like concrete and mortar. Cement’s main ingredients are limestone and clay, which are ground to a fine powder before being heated to 1,400–1,500°C in a cement kiln. This is the calcination process, which causes the mixture to release CO2 and transforms it into a lumpy substance called “clinker.” The clinker is then combined with other ingredients (such as gypsum) to create cement.

.jpg?width=643&name=figure-1_Cement%20Value%20Chain%20(1).jpg)

Exhibit 1: Cement manufacturing value chain

Source: IEA, Low-Carbon Transition in the Cement Industry, 2018; McKinsey & Company, Decarbonization of Industrial Sectors: The Next Frontier, 2018

This chemical calcination process produces about 60 percent of all CO2 released in cement production, and these emissions are harder to address than emissions from other steps in the production process. For example, steps such as heating the kiln, crushing materials, and transportation of materials can be decarbonized by switching to renewable energy sources, but changing the chemistry of cement production is not as straightforward.

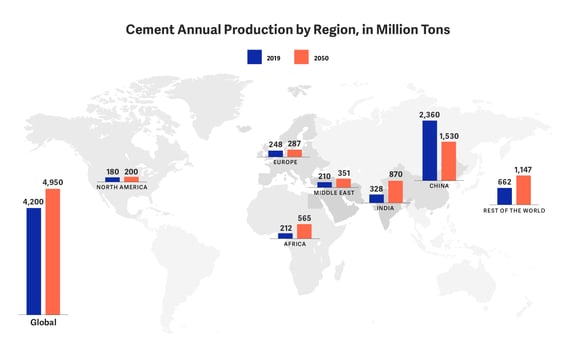

This problem is compounded by the fact that cement production is set to expand significantly in the coming decades, from 4.2 billion tons in 2019 to between 4.7 billion and 5.2 billion tons by 2050. The increasing demand will be driven by rapid growth in developing countries, particularly in India and certain regions of Africa.

Exhibit 2: Annual cement production by region

Source: Energy Transitions Commission, Reaching Net-Zero Carbon Emissions from Harder-to-Abate Sectors by Mid-Century, Sectoral Focus: Cement, 2019; IEA, Low-Carbon Transition in the Cement Industry, 2018; Statista.com, Distribution of Cement Production Worldwide in 2019, by Region, accessed on June 5, 2022; Latest Trends in Africa’s Cement Industry, accessed on June 5, 2022

To bring the cement sector in line with the Paris Climate Agreement, annual emissions will need to drop by at least 16 percent by 2030. This means that efforts across the entire value chain will play an important role — from demand management to improving process efficiency to using innovative technologies and solutions in cement and concrete manufacturing. The biggest impact, however, will come from tackling the process emissions directly.

Carbon Capture in Cement Production Facilities: A Partial Solution

Carbon capture, utilization, and storage (CCUS) technology provides one potential solution to these hard-to-avoid process emissions. CCUS involves pulling CO2 out of the exhaust gasses of cement production facilities, and then using it as a precursor for making valuable chemicals and fuels or storing it deep underground in geological formations. CCUS could eliminate as much as 90 percent of all emissions from cement manufacturing. However, scaling the technology up to meet the demands of the sector faces several significant challenges:

- CO2 concentration

The concentration of CO2 in flue gas from cement production is less than 20 percent, which is considerably lower than other industrial processes targeted by CCUS. This makes it costly to capture CO2 from cement plants. Innovative kiln designs that separate exhaust gasses could help improve the efficiency and economics of the capture process but would require significant investment and plant redesign. - Geographic constraints

For carbon storage, plants have to be situated close to a suitable geological formation, which are not common or evenly distributed around the world. And adding the cost of transporting and storing the captured CO2 to a low-value product like cement acts as a major barrier to widespread deployment of this technology. - Capital investment

CCUS technology is still an expensive solution and is far from being deployed at scale. There are viable routes to capturing emissions from cement plants for around $100 per ton of CO2, but these costs remain higher for cement than for any of the other hard-to-abate sectors like steel and fertilizer production. - Impact on consumers

Decarbonizing the cement sector, driven by deploying CCUS technology, is expected to add more than $100 per ton of cement. This means doubling the price of cement from today's average price of approximately $120 per ton and consequently increasing the cost of concrete by approximately 30%. This is a major barrier in an extremely price-sensitive market.

Although CCUS technology is primed to be part of the solution for decarbonizing the cement sector, these challenges mean that it’s unlikely to be a silver bullet. Fortunately, innovative solutions on the materials front have the potential to address cement’s process emissions in a cost-effective manner, and they are starting to drive a significant uptick in startup activity and VC interest.

Low-Carbon Cement: The Holy Grail

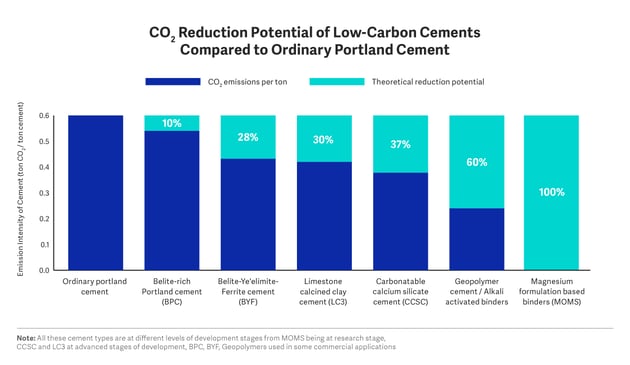

Compared with traditional ordinary Portland cement (OPC) — which contains more than 90 percent clinker and emits 0.6 tons of CO2 equivalent on average per ton of cement — low-carbon cement can reduce process emissions by anywhere from 10 percent to 100 percent. Low-carbon cement tackles the carbon emissions by directly targeting the ‘clinker,’ the most energy- and carbon-intensive part of the cement manufacturing process. There are a variety of ways to achieve this, including:

- Reducing the amount of clinker used in cement by substituting a portion of it with alternatives called supplementary cementitious materials, or SCMs

- Readjusting the way clinker is made by reducing the amount of limestone in feedstocks or modifying the calcination process

- Reformulating cement chemistries by developing new binders based on novel materials and low-carbon processes

Exhibit 3: CO2 reduction potential of various low-carbon cements

Source: S. Bhardwaj, D. Tewari, and B. Natarajan, Reducing Cement Sector Emissions: Approaches to Reduce the Demand of Cement from Construction, 2020; J. Lehne and F. Preston, Innovation in Low-Carbon Cement and Concrete, 2018

The challenge is producing a cement that could rival the cost of OPC and meet the stringent performance requirements of the construction industry. Startups such as Novacem and Calera have attempted to enter this space before, but they struggled to attract significant VC investment or lasting cooperation from major players in the cement industry. A number of barriers that constrained these startups, both on the supply and demand side of the value chain, remain today:

Supply-side barriers

- Stranded assets

A plant that can produce 1 million tons of ordinary Portland cement, the most commonly used cement, requires an investment of $200 million to $300 million. With over 2,000 cement kilns in existence today, there is significant resistance in the industry to any solution that requires a redesign of production facilities. - Raw material availability

Cement is a low-value product that is consumed in enormous quantities, so the raw inputs need to be cheap, reliable, and plentiful. - Cost

New manufacturing processes may increase material and energy costs or require additional investments in storage capacity or material processing. Margins in the cement industry are tight, and passing costs onto end-users is difficult in this price-sensitive market.

Demand-side barriers

- Consumer resistance

Engineers, architects, and contractors tend to prioritize safety over all else, and they therefore prefer to use a predictable and familiar product. Low-carbon cements may have different characteristics than traditional OPC, such as longer setting times or lower early strength. This can cause these products to be perceived as risky, costly, or difficult to use. - Fragmented value chain

The construction industry involves a huge number of actors engaging at different stages of the project. This reinforces the desire to use standard products that are consistent and predictable, further hindering adoption of alternative products. - Testing standards

Current testing standards for cements and concrete are highly prescriptive, often dictating the exact composition required for specific applications. These standards have been designed for OPC and may not be suitable for assessing the true performance of cements based on new chemistries. Setting new standards can take decades, and adoption by customers can be even slower.

Pathways Forward for Low-Carbon Cement

Despite these valid concerns, low-carbon cements are a key avenue to significantly mitigate emissions from cement production. While there has historically been no market for low-carbon cements, government agencies, real estate developers, and large corporations are collectively demanding ways to reduce the carbon footprints of their buildings and infrastructure, which is driving significant startup activity and VC interest in this space.

On the industry front, cement companies are taking notable actions but tend to be keen on solutions that are less disruptive to existing processes and assets — and that are cost effective. Startups can pair innovation with realistic understanding of the dynamics of the industry to drive a new wave of innovation in low-carbon cements.

In the next article in this three-part series, we will look at opportunities for innovation across the three main approaches to low-carbon cement: reducing the amount of clinker used; adjusting clinker production processes; and reformulating cement chemistries. The final article will delve into how VCs can help accelerate innovation in low-carbon cements and bring them to market faster.

While the challenges ahead are considerable, the scale of the opportunity is also enormous given the growing demand for cement worldwide. Making low-carbon cement a reality will require collaboration between innovators, investors, philanthropists, and policymakers, but a concerted effort could finally bring decarbonization of the cement sector within reach.

This is the first in a planned three-part series of blog posts offering expert analysis of low carbon cement's potential. The next post in the series is Three Pathways to Innovation in Low Carbon Cement. Sign up below to get notified about the next post in the series.

Sign Up To Receive the Next Post In This Series: