Innovating to Solve Two Crises at Once

COVID-19 is a cataclysm of epic scale that has disrupted life as we know it globally.

Early stage climate tech innovation is especially vulnerable to this disruption and, without swift, thoughtful action, we risk losing a decade of progress toward solutions that are critical for mitigating the most extreme effects of climate change. By applying lessons learned from the 2008 cleantech collapse, we can address this pandemic while also supporting innovation to tackle climate change.

Crisis, the Grandmother of Invention

If necessity is the mother of invention, then crisis is her grandmother. Humans have a long history of mobilizing quickly and effectively to confront great challenges in times of crisis. Nowhere is this phenomenon more evident today than in the many efforts to design simple, mass-producible ventilators for victims of the COVID-19 pandemic. These ad hoc innovation initiatives range from Tesla’s corporate skunk works use of automotive parts to Italian internet-enabled hackers’ repurposing of scuba gear to a collaboration between Italian and Canadian Nobel laureate luminaries.

And while it may seem hard to lift our gaze from the immediate health crisis, the world is undergoing a similarly high stakes economic and social cataclysm related to climate change. In the past three years alone, we have experienced the hottest temperatures on record in modern history; fought unprecedentedly destructive wildfires in Australia, Brazil, and California; weathered two thousand-year rainfall events in Texas; and mourned the death of an entire glacier due to ice melt.

Why, then, don’t we see a similar intense focus on innovation and deployment of climate solutions? Greenhouse gas (GHG) emissions continue to climb and, while there has been considerable progress made on inexpensive renewable energy generation and practical electric vehicles, we still lack cost-competitive, scalable solutions to address over 50 percent of global emissions.

Certainly, it is easier to focus on a single virus than on the myriad challenges of climate change. But there are also structural issues that make innovation in the global energy system very hard.

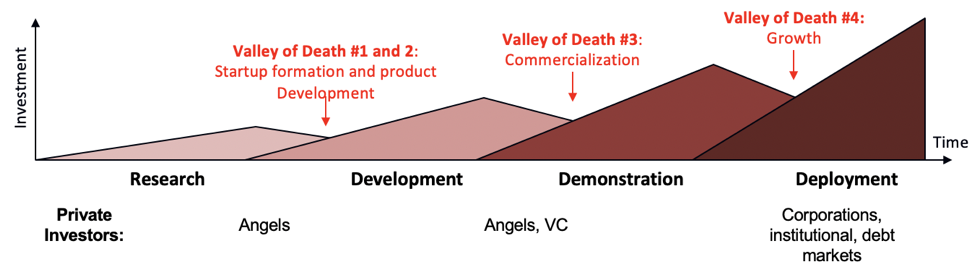

- Early stage innovations face long paths to market that require more capital than software, apps, and other investments that offer early stage investors tantalizingly rapid returns.

- These long paths to market are made slower and bumpier by the necessity of different sources and classes of capital as innovations graduate from labs to startups to pilot demonstrations to scale deployments—facing a “valley of death” at each stage.

- Exits for climate tech startups are challenging as the ultimate customers, partners, and acquirers for these early stage innovations are often large global companies with slow, complex, risk-averse technology adoption processes that can be prohibitively difficult for outsiders to navigate. Even worse, some of the major incumbents often see new technologies and startups as competitors that threaten their existing business.

- Some energy markets are highly regulated and complex. Insight into the impact of regulation/policy—and the ability to shape policy—to facilitate energy system transformation is generally beyond the capabilities of early stage innovators.

- The major constituents along the path to commercialization of early stage energy innovation—investors, project financiers, corporations, customers, and policymakers— don’t collaborate well.

In short, climate tech lacks a smooth and integrated development, funding, and scaling pipeline. The performance of this system is telling. Relative to a healthy innovation ecosystem like medtech, climate tech produces approximately one-tenth of the number of startups for an equivalently sized market.

And at a moment of urgent global need for energy innovation, we see that funding for the earliest stage climate innovation (including series A and before) was still at half of 2008 levels a full decade later in 2018.

Climate Tech Double Jeopardy

In addition to the structural challenges confronting climate innovators, we now have the added complication of the COVID-19 pandemic. There are numerous reports on how the current economic downturn disproportionately impacts startups. Ironically, these are organizations that are uniquely agile and should be able to thrive at moments of high risk and uncertainty. But the COVID-19 environment makes them especially vulnerable to failure.

So, while many startups are accustomed to having limited cash reserves, their inability to access their labs, manufacturing, or customers represents immediate and existential threats. Unlike many conventional businesses, startups do not have access to debt markets or lines of credit to help them weather the storm.

Indeed, New Energy Nexus’s March survey of California-based climate tech startups showed that 65 percent had less than four months of cash-on-hand and 90 percent did not expect to survive the current crisis without aid.

It would be devastating if the majority of climate tech startups that are in the process of bringing critical climate change solutions to market failed due to this crisis. It takes years for new technologies to be developed, demonstrated in the field, and deployed at scale; we cannot afford the loss of an entire generation of climate tech startups and the associated delay in technology commercialization.

Hard Won Insights from CleanTech’s 2008 Demise

This is not the first time that climate tech solutions have faced near-total annihilation. During the 2008 global economic crisis, sources of capital dried up, customer purchasing power declined, and many startups failed.

These failures generated poor investor returns, which further reduced investment and contributed to a “death spiral” that made “CleanTech” a toxic investment category for more than a decade. We lost an entire generation of climate tech innovations and the sector still hasn’t completely recovered.

Even during such dark times, there were some success stories that emerged. Tesla, for example, survived the downturn and is now the second-most valuable automotive manufacturer in the world. The Advanced Research Projects Agency-Energy (ARPA-E), launched in 2009, has generated 800 projects which have collectively attracted $2.6 billion of private investment.

Here are a few important lessons we can take from the 2008 CleanTech demise:

- Climate tech startups are vulnerable to a “death spiral” in times of crisis. Any intervention to help them survive would cost much less than the decade of lost progress in an entire sector.

- Crisis is an opportune time for investment while valuations, labor, and material costs are low. For example, Tesla acquired its Fremont facility and significant quantities of manufacturing equipment at deep discounts in 2010 (including a $50 million Schuler press for $6 million).

- Governments have a role to play. The American Recovery and Reinvestment Act (ARRA) of 2009 was partially responsible for the last decade’s progress on renewables and electric cars. The ARRA’s tens of billions of dollars of tax credits, grants, and loan guarantees supported the demand for and helped scale manufacturing of critical technologies like wind and solar, continuing to drive down costs. The Department of Energy’s Advanced Technology Vehicles Manufacturing loan of $465 million was also an important contributor to Tesla’s early progress.

- Support a trend; don’t favor a technology. Government isn’t good at picking winners in the private sector. Very public failures of government-backed ventures such as KiOR, INEOS Bio, and Solyndra created bad will in the political sphere and undermined confidence in the sector.

By learning from this history, and taking into account the special needs of climate tech entrepreneurs, it should be possible to convert a moment of existential crisis and the potential for another lost decade of innovation into a crucible of opportunity and solutions.

Innovation in the Time of COVID-19

Turning crisis into catalysis requires quick action, and we only have a few months to get it right. These government actions could prevent us from losing another decade of innovation.

- Provide equal and streamlined access to sustaining funds for startups. Accessing government funding is especially complicated for startups. Early stage startups may be pre-revenue and lack either tax or credit history, disqualifying or making it more difficult to work with funders. Later stage ones that have received venture capital or private equity money are ineligible for Small Business Administration loans. Few startups of any maturity have the capacity to navigate complex channels. Streamlining the process is essential and the two most important governmental small business relief programs—the Economic Impact Disaster Loan Program and the Paycheck Protection Program—must lift restrictions against venture-backed startups. Although there may be investors who benefit from government support, we shouldn’t gamble the success of the strongest solutions at a time when private capital is increasingly difficult to free-up. Equal treatment is fair and could allow the US to regain ground in climate tech lost since the last downturn.

- Make special efforts to preserve the most vulnerable early-stage companies. The earliest-stage climate tech startups are the most at risk during this crisis. These companies have often emerged from the research valley of death and face concept commercialization as their next big hurdle. Because these startups require quick action (which is incompatible with careful due-diligence) and because government is bad at picking winners, government should focus its intervention on expanding the resources of and fast tracking applications to established and successful grantmaking agencies such as ARPA-E, the Office of Energy Efficiency and Renewable Energy, and the National Science Foundation. Using standard screening filters within prioritized solution areas can expedite selection and support, giving the startups the greatest chance of survival.

- Provide incentives for active investors to spur available fund deployment. As we saw in the aftermath of the last financial crisis, there is both great opportunity (e.g., Tesla) and great peril (e.g., Solyndra) that comes with investing during a discontinuity. But we can’t afford to have capital sidelined or hesitant when it is urgently needed to create new jobs and advance critical climate solutions. Promoting additional and diverse investment by offering supportive funds and policies that shift risk profiles (e.g., matching government funding, deferred tax payments) can greatly shift investment criteria to favor faster deployment of available funds.

- Legislate and regulate to provide clear market signals that offer some degree of economic certainty. Understanding startup economics is challenging during the best of times given customer, competitor, team, and other dynamics. Even so, energy markets can be especially opaque for investors. Providing clear updates on levels and duration of government support at the federal, state, and municipal levels can offer a bit more certainty about important business model drivers that impact growth and investability. Using the current moment to clarify feed-in-tariffs, standards, tax credits, and other market drivers is a powerful tool to de-risk investments and stimulate focal points for innovation.

- Build integrated ecosystems. The first four recommendations will help ensure that startups survive the COVID-19 crisis. To increase the efficacy of our fight against the climate crisis, though, we must dramatically change the entire system of innovation. We need to build out entire ecosystems of startups, investors, large corporations, and other market participants such that they collaborate efficiently and march together in lock step toward common climate and financial goals. Only then will we be able to scale solutions rapidly enough to meet the climate crisis, and generate the jobs to help solve the economic fallout from COVID-19.

Humanity is in a race to prevent the most extreme effects of climate change and, even before the COVID-19 crisis, our early stage innovation efforts weren’t moving quickly enough.

The crisis illuminates just how fragile our climate tech innovation funnel is, and that we cannot afford to lose an entire generation of startups during this critical decade. We must first and foremost support existing startups during these challenging times. However, we must also change our approach to bringing new technologies to market.

Now is the time to bring together startups, investors, large corporations, and researchers in tight collaboration to streamline climate tech innovation and deployment. By combining a systems approach, lessons learned from the past, and the present zeal for innovation in the face of the COVID-19, we just might be able to address two crises at once.